Utilizing Technical Analysis with the NSE Option Chain: Identifying Trading Opportunities

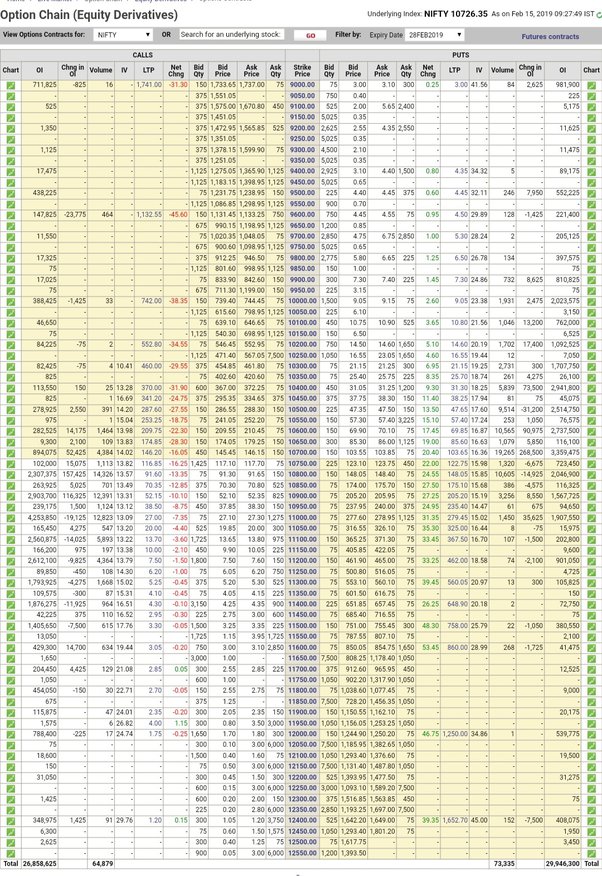

Technical analysis is a widely used approach in the financial markets to identify trading opportunities based on historical price data and patterns. When combined with the NSE option chain, technical analysis can provide valuable insights and help traders make informed decisions. By analyzing price trends, support and resistance levels, and other technical indicators, traders can identify potential entry and exit points in the option chain. Here are some key ways to utilize technical analysis with the NSE option chain to identify trading opportunities.

Price Patterns: Technical analysis focuses on identifying recurring price patterns that can indicate potential price movements. Chart patterns, such as triangles, double tops, and head and shoulders, can provide clues about future price action. By analyzing these patterns in conjunction with the option chain, traders can identify potential trading opportunities. For example, a breakout from a bullish chart pattern might suggest a potential increase in call option premiums, while a breakdown from a bearish pattern might lead to an increase in put option premiums. Learn what is demat.

Support and Resistance Levels: Support and resistance levels are price levels where the buying and selling pressure of a stock or index tends to converge. These levels can act as barriers, preventing the price from moving beyond a certain range. By identifying support and resistance levels on a price chart and comparing them with the option chain, traders can gauge market sentiment and potential price movements. When the price approaches a support level, it may be an opportunity to consider buying call options, while approaching a resistance level may indicate a potential opportunity for buying put options.

Moving Averages: Moving averages are popular technical indicators used to smooth out price data and identify trends. They can help traders identify potential entry and exit points in the option chain. For example, a crossover of a short-term moving average (e.g., 20-day moving average) above a long-term moving average (e.g., 50-day moving average) might signal a bullish trend and a potential opportunity for buying call options. Conversely, a crossover of a short-term moving average below a long-term moving average might indicate a bearish trend and a potential opportunity for buying put options.

Oscillators: Oscillators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), can help traders identify overbought and oversold conditions in the market. These indicators measure the momentum and strength of price movements, indicating when a stock or index may be due for a reversal. When combined with the option chain, traders can use oscillators to time their entry and exit points. For example, if an oscillator shows that a stock or index is in an overbought condition, it may be an opportunity to consider buying put options.

Volume Analysis: Volume is an essential component of technical analysis, as it represents the level of market participation and can indicate the strength or weakness of price movements. Analysing volume patterns in conjunction with the option chain can provide valuable insights into market sentiment. For example, a significant increase in volume accompanying a price breakout might indicate a strong bullish trend and a potential opportunity for buying call options